How to Tell How Much Car Insurance You Are Entitled To After a Car Accident

Posted by Wetherington Law Firm | Articles

- Articles

- Artificial Intelligence

- Car Accidents

- Class Action Lawsuit

- Comparative Negligence

- Crime Victim

- Defective Vehicles

- Disability

- Kratom Death and Injury

- Legal Marketing

- Motor Vehicle Accidents

- News/Media

- Other

- Pedestrian Accidents

- Personal Injury

- Results

- Sexual Assault

- Truck Accidents

- Uber

- Wrongful Death

Categories

The following article is the second in a series of 9 articles that explain the different concepts involved in insurance policies as they relate to personal injury in automobile accidents. This article focuses on explaining the declarations page in an insurance policy.

How to Read a Car Insurance Declarations Page

The first page of any insurance policy is usually the Declarations page. An automobile insurance policy is no exception. The declarations page contains a summary of your coverage and limitations.

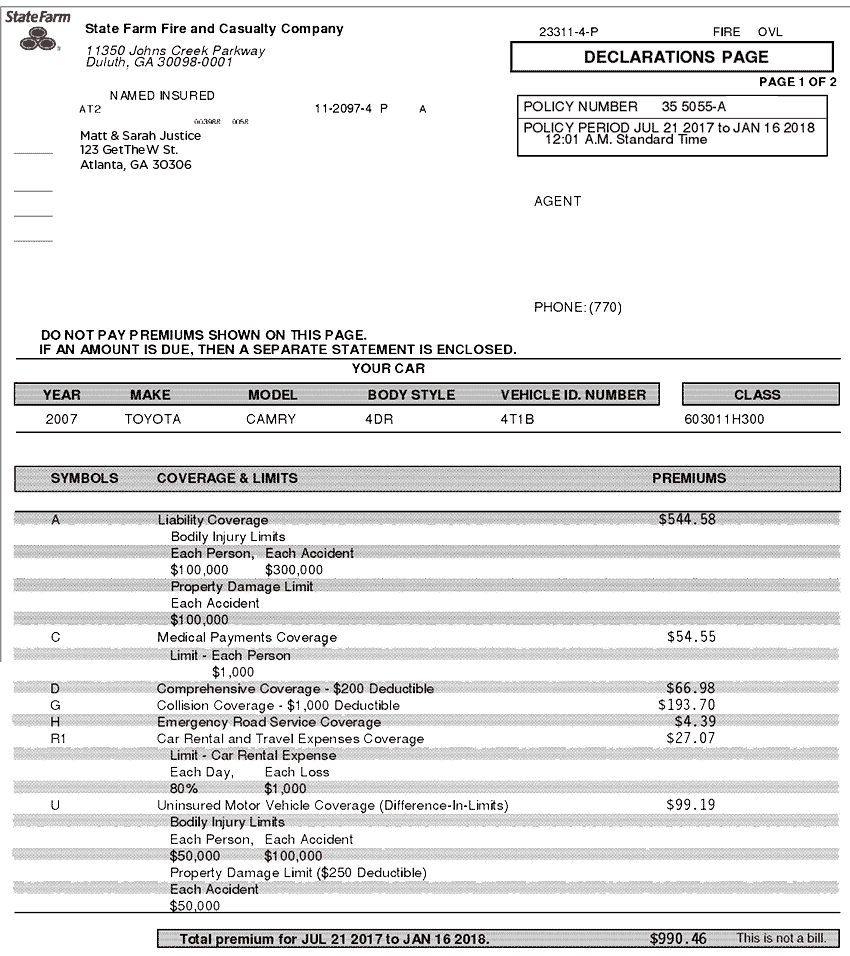

To illustrate the various parts of an automobile insurance policy declarations page, we will use the example of Matt & Sarah Justice. They own a 2007 Toyota Camry. Here is their declarations page from State Farm:

The declarations page contains the following information:

- The name(s) of the insured (the named insured) (Matt & Sarah Justice).

- The policy number (35 5055-A).

- The insurance agent.

- The term of the policy (July 21, 2017 – January 16. 2018).

- The vehicle(s) insured (2007 Toyota Camry).

- The types of coverage (Liability, Medical, Comprehensive, Roadside, and Uninsured/Underinsured).

- The cost of each type of coverage (the premium).

- Coverage for someone injured in a car accident caused by Matt or Sarah (Liability – $100,000).

- Coverage if Matt or Sarah are injured by someone else (UM -$50,000).

- Coverage for damage to their vehicle ( Property -$50,000).

- Coverage for Matt or Sarah’s medical bills, regardless of who is at fault (Medical – $1,000)

The Insureds

The people listed in this section are the people who own the policy. They are the only people authorized to make changes to the policy or to cancel it. Often, insurance policies will list additional insureds, such as children.

Effective Dates of Policy

As anyone who has ever received a traffic citation will know, the effective dates of your automobile policy are very important. Having an expired policy will result in an additional citation. Your declaration sheet will show the dates the policy begins and ends. This policy began on July 21, 2017, and ends on January 16. 2018. If an automobile accident with this vehicle occurred outside of these dates, there would be no coverage under this insurance contract.

Types of Liability Coverage

In this example, we can see that this policy provides Bodily Injury Liability coverage with limits of $100,000 Each Person and $300,000 Each Accident. Bodily injury (BI) liability is third-party liability insurance that covers another person’s injury or death caused by the negligence of the insured driver. This type of coverage insures against injury to people, not damage to motor vehicles or any other type of property damage.

This policy example provides a limit of $100,000 in Property Damage Liability that would coverage damage to someone else’s vehicle and/or property in the event of an accident. It provides Uninsured Motorist coverage with limits of $50,000 Each Person and $100,000 Each Accident, Underinsured Motorist coverage with limits of $50,000 Each Person and $100,000 Each Accident and Medical bill coverage with limits of $1,000 Each Person.

Umbrella Policy

Setting the appropriate Bodily Injury coverage limits is imperative. If these limits are set too low, you can expose yourself to personal liability where your personal assets and income can be jeopardized. In order to make sure they are appropriately covered, many people choose to purchase an “umbrella” policy. This type of policy is over and above the regular liability insurance in force. These policies are relatively inexpensive and generally sold in increments of $1 million. Umbrella coverage policies pay on top of other insurance policies that are in force. If the Justice family purchased a $1 million umbrella policy, it would provide a total of $1,100,000 for injuries to any person making a claim against the Justice’s on their automotive policy. Umbrella policies provide additional coverage on other types of insurance policies too. For example, if the Justice’s have a homeowner’s insurance policy with a $500,000 liability limit, the umbrella policy would increase that coverage to $1,500,000.

Limits of Liability/Bodily Injury Liability

Understanding the “Each Person” and “Each Accident” terminology in insurance policies are important as well. In the example above the Bodily Injury liability shown in the example above states there are liability limits of $100,000 for “Each Person” and $300,000 for “Each Accident.” This policy limits the amount of money that will be paid out on a “per person” basis. In the event of an automobile accident in which more than one person is injured or killed, the policy sets the maximum amount that can be paid for any one person’s injury or death at $100,000. Additionally, no matter the extent of injuries or the amount of people injured or killed, the total amount that can be paid out per accident is limited to $300,000. States typically provide minimum amounts that are acceptable for policy coverage. In Georgia, the minimum is $25,000.

Limits of Liability/Property Damage Liability

The next type of coverage on most automotive policies is the “Property Damage Liability” (PD). This coverage provides money to pay others for any damage to property as a result of the insured’s actions. In many declarations’ pages, insurance companies state these by providing the Bodily Injury limits followed by the Property Damage limits. For example, if the declarations page stated 50/100/50, it would mean that the BI limits are $50,000 per person and $100,000 per accident with property damage limits of $50,000. These types of liability limits are referred to as split liability limits. The liability limits are broken down by (1) each person, (2) each occurrence, and (3) property damage.

Although it is more commonly seen in commercial motor vehicle policies, some individuals purchase automobile insurance policies with combined single limits. This provides one total limit of liability for all aspects of an accident. If the insured has a combined single limit of $500,000, no more money will be paid out from the policy. If one person in the accident receives an award for $300,000 and a second person receives $200,000, this would reach the limits of the coverage. If the accident also caused an additional $75,000 in property damage, the insured would be personally responsible for the additional $75,000 in damages.

Uninsured Motorist, Underinsured Motorist, Personal Injury Protection

The next three types of coverage listed on the Declaration sheet are first-party types of coverage: uninsured motorist (UM) coverage, underinsured motorist (UIM) coverage, and personal injury protection (no-fault) coverage. This coverage is very important and merits its own article. To learn about underinsured motorist coverage, click here. To learn more about uninsured motorist coverage, click here.

Add-On vs Reducing Coverage

Two key terms are important to understand when learning about insurance coverage as it relates to automobile insurance. The first term is “stacking.” If an insured has several vehicles all insured with liability coverage, those policies are not allowed to be “stacked” (or added together) to obtain additional liability coverage beyond a policy’s stated liability limit. For some types of first-party liability coverage, such as uninsured motorists, underinsured motorists and no fault, stacking is sometimes permitted. This information is not listed on the policy provided above, which is normal. It often requires obtaining a document called a Selection/Rejection Form. This form and its implications is explained in our article on UIM Coverage.

Damages to Your Auto

The last two types of coverage shown in the example declarations page, refer to first-party insurance coverage for damage to your vehicle. These are coverages for “Other than Collision” and “Collision.” “Other than Collision” coverage used to be called “Comprehensive.” It covers damages to your vehicle in non-collision situations. It includes theft and acts of nature such as hailstorms, tree limb damage, fire, tornadoes, earthquakes, etc.

Collision coverage will pay for damage to your own vehicle when it collides with another vehicle or another vehicle collides with it. In the example shown above, there is a $1,000 deductible payment required, meaning the policy owner must pay for the first $1,000 in damages, then the insurance company will pay the reminder of the damages.

Conclusion

Insurance declaration pages are intentionally hard to read. If you have questions about what insurance you have, whether that insurance provides coverage for you, or how much insurance you should purchase, contact us. For no charge, we will evaluate your insurance and provide guidance on your next best steps. To learn more about auto insurance, continue on at one of the following links:

- When Can I Recover from Someone’s Else’s Insurance?

- The Declarations Page (this article)

- Duty to Defend

- Reservation of Rights

- Bad Faith

- Commercial General Liability

- Direct Actions Against Insurance Companies

- Uninsured Motorists

- Underinsured Motorists