Home Insurance Claim Adjuster Secret Tactics

Posted by Wetherington Law Firm | Articles

- Articles

- Artificial Intelligence

- Car Accidents

- Class Action Lawsuit

- Comparative Negligence

- Crime Victim

- Defective Vehicles

- Disability

- Kratom Death and Injury

- Legal Marketing

- Motor Vehicle Accidents

- News/Media

- Other

- Pedestrian Accidents

- Personal Injury

- Results

- Sexual Assault

- Truck Accidents

- Uber

- Wrongful Death

Categories

TL;DR:

When dealing with a home insurance claim, understanding the tactics used by adjusters is crucial. Familiarize yourself with the claims process, document everything thoroughly, and be prepared to negotiate. Knowing your policy inside out and maintaining clear communication can significantly influence the outcome of your claim. Remember that insurance adjusters do not work for you but for insurance companies. Some of the home insurance claim secret tactics include:

- Minimizing Damage Estimates: Adjusters may downplay the extent of the damage to reduce the payout. It’s essential to provide thorough documentation and evidence of the damage.

- Delay Tactics: Sometimes, adjusters may delay the process to pressure you into accepting a lower settlement. Stay proactive and follow up regularly.

- Policy Interpretation: Adjusters may interpret policy language in a way that favors the insurance company. Familiarize yourself with your policy to counter any misinterpretations.

Key Highlights:

- Understand the claims process and adjuster roles.

- Document all damages and communications meticulously.

- Know your insurance policy details.

- Be prepared to negotiate settlements.

- Maintain clear and respectful communication with the adjuster.

Home insurance is designed to protect homeowners from financial loss due to unexpected events, such as fire, theft, or natural disasters. In the United States, the average homeowner’s insurance premium is around $1,500 per year, but this can vary significantly based on location, coverage, and the homeowner’s claims history. Understanding how to effectively navigate the claims process can make a substantial difference in the outcome of your insurance claim.

The role of a claims adjuster is pivotal in determining whether a claim is approved, denied, or settled for a lesser amount. Adjusters assess the damage, evaluate policy coverage, and ultimately decide how much compensation a homeowner will receive. They are trained professionals who follow specific protocols and guidelines, but they also have their own tactics that can influence the claims process.

To maximize your chances of a favorable outcome, it’s essential to understand these tactics and how to respond effectively. By approaching the claims process with knowledge and preparation, you can ensure that you receive the compensation you deserve.

Understanding the Claims Process

The Role of Claims Adjusters

Claims adjusters are responsible for investigating insurance claims and determining the appropriate compensation based on the policy terms. Their job includes:

- Visiting the site of the damage.

- Interviewing the policyholder and witnesses.

- Collecting evidence and documentation.

- Evaluating repair estimates and costs.

Adjusters often work for the insurance company, which can sometimes lead to a conflict of interest. They may aim to minimize payouts to protect the insurer’s bottom line. Understanding this can help you prepare for possible challenges during your claim.

Steps in the Claims Process

- Filing a Claim: Notify your insurance company as soon as damage occurs. Provide them with essential details, including the date, time, and nature of the loss.

- Claim Assignment: Once a claim is filed, an adjuster will be assigned to your case. They will reach out to you to gather more information.

- Investigation: The adjuster will conduct a thorough investigation, which may include visiting your home, interviewing you, and reviewing documentation.

- Evaluation: After gathering all relevant information, the adjuster will evaluate the claim based on your policy’s coverage.

- Settlement Offer: The adjuster will present a settlement offer, which you can accept, negotiate, or dispute.

- Claim Resolution: Once both parties agree on the settlement, the claim will be closed, and you will receive the compensation.

Home Insurance Claim Adjuster Secret Tactics

If you’ve ever had to file a home insurance claim, you probably know it can feel confusing, slow, and sometimes even unfair. You pay your premiums every month expecting help when you need it, but once the claim process begins, things don’t always seem so simple. You’re not imagining it, many homeowners feel the same way.

So, who are the people on the other side of this process? Insurance companies usually send out claim adjusters. Their job is to investigate the damage, figure out how much repairs will cost, and recommend how much the insurance company should pay. Sounds fair, right? The catch is that adjusters work for the insurance company, not for you. That means their goal is often to save the company money.

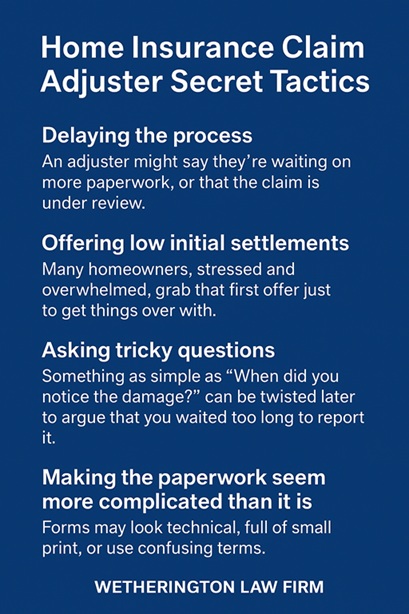

One of the most common tricks is delaying the process. An adjuster might say they’re waiting on more paperwork or that the claim is under review. Weeks can turn into months. Why? Because the longer you wait, the more likely you are to get tired and accept whatever offer comes your way.

Another tactic is offering a low first settlement. It’s like throwing out a “test” number to see if you’ll take it. Many homeowners, stressed and overwhelmed, grab that first offer just to get things over with. But often, that number is far below what you actually need to cover repairs.

Adjusters may also ask tricky questions. Something as simple as “When did you notice the damage?” can be twisted later to argue that you waited too long to report it, making your claim seem weaker. It’s not always about what you say; it’s about how they can use your words against you.

Then there’s the mountain of complicated paperwork. Forms may look technical, full of small print, or use confusing terms. This can leave you second-guessing yourself and more willing to trust whatever the adjuster says, even if it’s not in your best interest.

So, how can you protect yourself? First, stay patient but firm. Don’t let delays push you into rushing. Second, always read offers carefully, and don’t be afraid to ask for more if the settlement doesn’t cover your costs. Third, keep notes of every conversation, including dates and what was said—that way, you have a record if things get tricky. And finally, never feel pressured to answer questions on the spot. It’s okay to pause and think before responding.

Remember, you have more power than you think. The insurance company may try to protect its bottom line, but you’re protecting your home and your family’s comfort. Stay calm, stay informed, and don’t settle for less than what’s fair.

How to Protect Yourself Against Insurance Adjusters

Importance of Documentation

Documentation is key in supporting your claim. The more evidence you have, the stronger your case will be. This includes:

- Photos and Videos: Capture clear images of all damages from multiple angles. Ensure you document any personal property that was affected.

- Repair Estimates: Obtain quotes from contractors for repairs. This can help you challenge any low estimates provided by the adjuster.

- Receipts and Invoices: Keep records of any expenses related to the damage, such as temporary housing or repairs.

- Communication Records: Document all interactions with the adjuster, including dates, times, and content of conversations. This can help if disputes arise later.

Creating a Claim File for Presentation to Adjusters and Insurance Companies

Organize all your documentation in a claim file. This can include:

- A summary of the incident.

- All correspondence with your insurance company.

- Copies of your insurance policy.

- Any relevant receipts or estimates.

Having a well-organized claim file will help you present your case clearly and effectively.

Knowing Your Policy

Key Policy Components

Understanding your insurance policy is crucial for a successful claim. Familiarize yourself with:

- Coverage Types: Know what types of damage are covered under your policy (e.g., dwelling, personal property, liability).

- Deductibles: Understand how much you will need to pay out of pocket before the insurance kicks in.

- Exclusions: Be aware of what is not covered by your policy. This can help you avoid surprises later.

- Limits: Know the maximum amount your policy will pay for specific types of claims.

Reviewing Your Policy

Take the time to read through your policy documents. Highlight key sections and make notes on anything you don’t understand. If necessary, reach out to your insurance agent for clarification.

Negotiating Settlements with Insurance Adjusters

Preparing for Negotiation

Once the adjuster presents a settlement offer, you may find it necessary to negotiate. Here’s how to prepare:

- Research Comparable Claims: Look into similar claims in your area to understand typical payouts. This can provide a basis for your negotiation.

- Know Your Value: Calculate the total cost of damages, including repairs, lost property, and any additional expenses incurred.

- Be Professional: Approach negotiations calmly and respectfully. Aggression can lead to a breakdown in communication.

Tactics for Successful Negotiation with Adjusters

- Counter Offer: If the initial offer is lower than expected, don’t hesitate to make a counteroffer based on your research and documentation.

- Present Evidence: Use your organized claim file to present evidence that supports your case. This can include repair estimates, photos, and communication records.

- Be Persistent: If you feel the offer is inadequate, continue to negotiate. Sometimes, it may take several discussions to reach a satisfactory agreement.

Maintaining Clear Communication

Effective Communication Strategies

Communication with your adjuster can significantly impact your claim’s outcome. Here are some strategies:

- Be Clear and Concise: When discussing your claim, be straightforward about your expectations and the details of the damage.

- Follow Up Regularly: Stay in touch with your adjuster to check on the progress of your claim. This shows your commitment and keeps your case on their radar.

- Document Conversations: Keep a record of all communications, noting dates, times, and key points discussed. This can be helpful if disputes arise.

Building a Professional Relationship

Building a rapport with your adjuster can also be beneficial. A positive relationship can lead to better communication and potentially a more favorable outcome.

- Be Respectful: Treat your adjuster with respect, even if you disagree with their assessment.

- Express Gratitude: A simple thank you can go a long way. Acknowledging their efforts can foster goodwill.

Conclusion

Understanding the tactics used by home insurance claim adjusters can significantly enhance your ability to secure a favorable settlement. By familiarizing yourself with the claims process, documenting everything diligently, knowing your policy inside and out, negotiating effectively, and maintaining clear communication, you can navigate the claims landscape with confidence.

Remember, your goal is to ensure that you receive the compensation you deserve. Take the time to prepare, stay organized, and advocate for yourself throughout the claims process. If necessary, consider seeking assistance from a public adjuster or legal professional to further support your claim. Don’t hesitate to take action; your home and financial well-being depend on it. If you need legal support, contact our attorneys for free case evaluation.