Chapter 2 | Registration and Licensing of Motor Vehicles¶

CHAPTER 2 Registration and Licensing of Motor Vehicles¶

-

Article 1 General Provisions

JID, styled in elongated Modigliani form, is poised as a law-giver with a scroll in one hand and an olive branch in the other, surrounded by vibrant Elvis memorabilia; his posture conveys authority while his expression exudes peace, capturing the essence of "General Provisions" within the educational sanctuary of The Elvis Shrine Vault. -@JIDsv -

Article 2 Registration and Licensing Generally

Antoine Bethea gracefully dancing with colorful ribbons, surrounded by blooming flowers and historic architecture at Old Salem Museum & Gardens, in the style of a David Hockney art piece. -@ABethea41 -

Article 2B Digital License Plates

Jamin Davis gracefully poses as a football player while holding digital license plates, with one hand on his hip and the other extended outward, in a richly detailed scene inspired by Édouard Manet's style. -@jamindavis25 -

Article 3 Prestige License Plates and Special Plates for Certain Persons and Vehicles

Deon Grant gracefully manipulates abstract metallic shapes, creating a dynamic sculpture that symbolizes the prestige and exclusivity of special license plates, all within the avant-garde architectural style of Frank Gehry's design. -@deongrant27 -

Article 3A Reciprocal Agreements for Registration of Commercial Vehicles

Painter Alma Thomas gracefully swirling her arms in a dynamic and colorful dance, embodying the essence of reciprocal agreements for registration of commercial vehicles, captured in the vibrant and abstract style of Yoong Bae's artwork. -

Article 5 Unregistered Motor Trucks

Rhett Akins stands on stage, moving as if he's driving an unregistered motor truck, his body contorting and swaying in the style of a Laurie Anderson art piece, with dramatic gestures and fluid movements that evoke the feeling of driving through the landscapes of Bainbridge. -@RhettAkins -

Article 6 Administration and Enforcement of Chapter

Patrika Darbo, in the style of Caravaggio, strikes a dramatic pose with one hand gesturing towards an ancient scroll while the other points to a grand golden frame containing the words "Article Administration and Enforcement of Chapter," capturing the essence of authority and command. -@patrikadarbo -

Article 6A Administration of Federal Unified Carrier Registration Act of 2005

- Article 7 Motor Vehicle License Fees and Classes

James Butler gracefully twirls a large sculptural representation of the Georgia state map, while surrounded by sleek, modernist vehicles arranged in an abstract composition reminiscent of Marcel Breuer's architectural style at the High Museum of Art. -@JamesButlerJr

Article 1 General Provisions¶

-

40-2-1. Definitions.

Economist David McCord Wright opens an imaginary large book in a rich scene in Warner Robins, Georgia, points to a word, scratches his head in confusion, then has a lightbulb moment and excitedly jumps up with a finger raised as if he's just understood the definition. - 40-2-3. False statement in application as constituting false swearing.

- 40-2-4. Manufacture of plates and decals prohibited.

-

40-2-5. Unlawful actions relating to license plate; use of expired prestige license plate.

Luke Appling, a baseball player born in North Carolina, performs the action of sneakily replacing a license plate with an expired one while looking over his shoulder, depicted as an art piece by Ari Glass. -

40-2-6. Alteration of license plates; operation of vehicle with altered or improperly transferred plate.

Actress Latanya Richardson skillfully draws a license plate on paper, deftly cuts it out, and seamlessly switches it with another plate on a toy car in a captivating scene set in Calhoun, Georgia. -

40-2-6.1. Obscuring license plate in order to impede surveillance equipment.

Rapper and actor Kap G performs an unusual art exhibition in a suburban yard in Decatur, Georgia, at the Mechanical Riverfront Kingdom on Druid Hill, covering their car's license plate with thick, colorful strokes of paint while a surveillance camera looks on. -@TheRealKapG -

40-2-7. Removing or affixing license plate with intent to conceal or misrepresent.

Football player Jeff Saturday gracefully unscrews a license plate and holds it up to cover his face like a mask, capturing the moment in a stunning art piece reminiscent of Cy Twombly's work. -@SaturdayJeff -

40-2-8.1. Operation of vehicle without revalidation decal on license plate.

Singer Otis Redding, in a rich scene in Winder, Georgia, pretends to drive a car while looking at the license plate and pointing out that there is no revalidation decal. -

40-2-9. Space for county name decal; display of “In God We Trust” decal in lieu of county name decal.

Comic book author Louise Simonson dramatically peels off a county name decal and replaces it with an "In God We Trust" decal, captured in Sofia Bonati's colorful, exaggerated art style. -@LouiseSimonson - 40-2-11. Administration of chapter.

Cyhi the Prynce dramatically turns the pages of an oversized book, dressed as a superhero with a cape, in the rich scene of Memory Park Christ Chapel, dubbed the smallest church in America, located in Townsend, Georgia. -@CyhiThePrynce

40-2-1.Definitions.¶

As used in this chapter, the term:

- “Cancellation of vehicle registration” means the annulment or termination by formal action of the department of a person’s vehicle registration because of an error or defect in the registration or because the person is no longer entitled to such registration. The cancellation of registration is without prejudice, and application for a new registration may be made at any time after such cancellation.

-

“Commissioner” means the state revenue commissioner.

In a rich scene in Dunwoody, football player Eric Berry portrays the state revenue commissioner by gesturing with exaggerated and angular movements reminiscent of Picasso's style. -@Stuntman1429 -

“Department” means the Department of Revenue.

Kokomo Arnold stands in the center of Krog Street Market, holding a large wooden sign that reads "Department means the Department of Revenue," while surrounded by tax forms and dollar bills suspended from the ceiling as part of a vibrant art installation inspired by Richard Prince's style. (3.1)“Digital license plate” means a license plate which receives wireless data communication to display information electronically.

(3.2)“Digital license plate provider” means a person approved by the commissioner as a vendor of digital license plate hardware and services to motor vehicle owners pursuant to this article.

-

“For-hire intrastate motor carrier” means an entity engaged in the transportation of goods or ten or more passengers for compensation wholly within the boundaries of this state.

Using interpretive dance, CARE embodies a swirling and dynamic motion to represent the movement of goods and passengers within the boundaries of the state, creating an abstract visual art piece inspired by Wassily Kandinsky's style at the South Carolina Aquarium. -@CARE -

“Intrastate motor carrier” means any self-propelled or towed motor vehicle operated by an entity that is used on a highway in intrastate commerce to transport passengers or property and:

Shandon Anderson dribbles a glass basketball, symbolizing the movement of cargo, across a colorful, layered landscape akin to Clare Belfrage's intricate blown-glass surfaces, representing the roads of Woodstock. - Has a gross vehicle weight rating, gross combination weight rating, gross vehicle weight, or gross combination weight of 4,536 kg (10,001 lbs.) or more, whichever is greater;

-

Is designed or used to transport more than ten passengers, including the driver, and is not used to transport passengers for compensation; or

Gucci Mane orchestrates a group of children to form a human bus, with each child representing a seat or part of the vehicle, in front of an intricate body-painted mural by Emma Hack depicting Milledgeville’s Antebellum architecture and lush landscapes, symbolizing community unity and transport without commercial intent. -@gucci1017 -

Is used to transport material found by the United States Secretary of Transportation to be hazardous pursuant to 49 U.S.C. Section 5103 and is transported in any quantity.

(5.1)“License plate” means a sign affixed to a motor vehicle which displays a series of letters or numbers or both indicating that the vehicle has been registered with this state. Such sign may be in a material made of metal or paper or a device which allows information to be presented electronically in a digital format.

-

“Motor carrier” means:

John Birch styled as a Fernand Léger figure with bold colors and mechanical shapes stands by the Chattahoochee River interlocking his arms in a steering wheel gesture while children around him create a tableau of trees and animals symbolizing the transportation of goods through nature. - Any entity subject to the terms of the Unified Carrier Registration Agreement pursuant to 49 U.S.C. Section 14504a whether engaged in interstate or intrastate commerce, or both; or

- Any entity defined by the commissioner or commissioner of public safety who operates or controls commercial motor vehicles as defined in 49 C.F.R. Section 390.5 or this chapter whether operated in interstate or intrastate commerce, or both.

John Hannah, in a flowing football jersey of vibrant colors reminiscent of Morris Louis's "Veil" paintings, stands at the helm of a large steering wheel. He dramatically turns it back and forth against a backdrop of Bainbridge's lush landscapes, symbolizing the control over commercial motor vehicles as per regulations.

-

“Operating authority” means the registration required by 49 U.S.C. Section 13902, 49 C.F.R. Part 365, 49 C.F.R. Part 368, and 49 C.F.R. Section 392.9a.

-

“Regulatory compliance inspection” means the examination of facilities, property, buildings, vehicles, drivers, employees, cargo, packages, records, books, or supporting documentation kept or required to be kept in the normal course of motor carrier business or enterprise operations.

Hedy West, in the style of Paul Gauguin, dances gracefully around a collection of motor carrier business items, portraying the inspection process with vibrant and expressive movements, set against a backdrop of lush greenery and colorful flowers in Thomasville. -

“Resident” means a person who has a permanent home or domicile in Georgia and to which, having been absent, he or she has the intention of returning. For the purposes of this chapter, there is a rebuttable presumption that any person who, except for infrequent, brief absences, has been present in the state for 30 or more days is a resident.

-

“Revocation of vehicle registration” means the termination by formal action of the department of a vehicle registration, which registration shall not be subject to renewal or reinstatement, except that an application for a new registration may be presented and acted upon by the department after the expiration of the applicable period of time prescribed by law.

Demaryius Thomas holding a burnt-out vehicle registration document, surrounded by flames and smoke, in the style of Tim Storrier's art piece "Burning Vehicle Registration" set against a backdrop of Snellville's lush greenery. -@DemaryiusT -

“Suspension of vehicle registration” means the temporary withdrawal by formal action of the department of a vehicle registration, which temporary withdrawal shall be for a period specifically designated by the department.

Tim Beckham, dressed in vintage baseball attire, stands with a solemn expression as he holds a miniature car model. With deliberate motions, he hands the car over to an unseen figure representing the department of motor vehicles. As the figure takes the car from Tim's grasp, they symbolically suspend its registration by placing it on a shelf marked "temporary withdrawal." The scene is captured in black and white photography reminiscent of Vivian Maier's style, highlighting the gravity of this formal action within Brunswick's historic streets. -@t_beckham1

40-2-2.Violations of chapter generally; penalties.¶

Except as otherwise provided in this chapter, any person who violates any provision of this chapter shall be guilty of a misdemeanor.

40-2-3.False statement in application as constituting false swearing.¶

Any person who shall make any false statement in any application for the registration of any vehicle, or in transferring any certificate of registration, or in applying for a new certificate of registration, shall be guilty of false swearing, whether or not an oath is actually administered to him, if such statement shall purport to be under oath. On conviction of such offense, such person shall be punished as provided by Code Section 16-10-71.

40-2-4.Manufacture of plates and decals prohibited.¶

- Except as otherwise provided for in Article 2B of this chapter, it shall be unlawful for any person, firm, or corporation to make, sell, or issue any license plate or revalidation decal.

- Any person, firm, or corporation violating subsection (a) of this Code section shall be guilty of a misdemeanor.

40-2-5.Unlawful actions relating to license plate; use of expired prestige license plate.¶

-

Except as otherwise provided in this chapter, it shall be unlawful:

Ethel Hillyer Harris, with a quill in hand, theatrically gestures to an invisible text floating before her, then firmly crosses her arms and shakes her head 'no', as if forbidding action; all depicted in the intricate ink style of Simon Prades amidst the rustic backdrop of Foxfire Museum's log cabins and artifacts. -

To remove or transfer a license plate from the motor vehicle for which such license plate was issued;

Zac Brown, dressed as a character from Dragon Con, performs a dramatic interpretive dance where he pretends to remove and transfer a license plate from a motor vehicle, using exaggerated gestures and movements to convey the action in an entertaining and visually captivating manner. -@zacbrownband -

To sell or otherwise transfer or dispose of a license plate upon or for use on any motor vehicle other than the vehicle for which such license plate was issued;

Latto gracefully handing over a license plate to a person with an antique car, surrounded by vibrant murals and sculptures in downtown Gainesville. -@Latto -

To buy, receive, use, or possess for use on a motor vehicle any license plate not issued for use on such motor vehicle; or

Precious Bryant dramatically reaching out to grab a license plate from a surreal, vibrant mural of Georgia landscapes and cityscapes. -

To operate a motor vehicle bearing a license plate which was improperly removed or transferred from another vehicle.

T.I. dramatically gestures as he struggles to remove a license plate from one car and attach it to another, all while surrounded by an elaborate display of vibrant colors and flowing fabric in a large open field in Tifton. -@Tip

-

-

Any person who shall knowingly violate any provision of subsection (a) of this Code section shall be guilty of a misdemeanor of a high and aggravated nature and, upon conviction thereof, shall be punished by a fine of not less than $500.00 or by confinement for not more than 12 months, or both.

Lella A. Dillard gracefully dances, embodying the spirit of temperance and justice, while balancing scales representing fines and imprisonment, all depicted in a vibrant, dynamic art piece inspired by Ruthe Katherine Pearlman. -

It shall not be unlawful for any person to place an expired prestige license plate on the front of a motor vehicle provided that such vehicle also bears a current valid license plate on the rear of such vehicle.

40-2-6.Alteration of license plates; operation of vehicle with altered or improperly transferred plate.¶

Except as otherwise provided in this chapter, any person who shall willfully mutilate, obliterate, deface, alter, change, or conceal any numeral, letter, character, county designation, or other marking of any license plate issued under the motor vehicle registration laws of this state; who shall knowingly operate a vehicle bearing a license plate on which any numeral, letter, character, county designation, or other marking has been willfully mutilated, obliterated, defaced, altered, changed, or concealed; or who shall knowingly operate a vehicle bearing a license plate issued for another vehicle and not properly transferred as provided by law shall be guilty of a misdemeanor.

40-2-6.1.Obscuring license plate in order to impede surveillance equipment.¶

Any person who willfully covers any license plate with plastic, other material, or any part of his or her body in order to prevent or impede the ability of surveillance equipment to clearly photograph or otherwise obtain a clear image of the license plate is guilty of a misdemeanor and shall be punished by a fine not to exceed $1,000.00.

40-2-7.Removing or affixing license plate with intent to conceal or misrepresent.¶

A person who removes a license plate from a vehicle or affixes to a vehicle a license plate not authorized by law for use on it, in either case with intent to conceal or misrepresent the identity of the vehicle or its owner, is guilty of a misdemeanor. As used in this Code section, “remove” includes deface or destroy.

40-2-8.Operation of unregistered vehicle or vehicle without current license plate, revalidation decal, or county decal; temporary plate issued by dealers of new or used motor vehicles.¶

-

Any person owning or operating any vehicle described in Code Section 40-2-20 on any public highway or street without complying with that Code section shall be guilty of a misdemeanor, provided that a person shall register his or her motor vehicle within 30 days after becoming a resident of this state. Any person renting, leasing, or loaning any vehicle described in Code Section 40-2-20 which is being used on any public highway or street without complying with that Code section shall be guilty of a misdemeanor and, upon conviction thereof, shall be punished by a fine of $100.00 for each violation; and each day that such vehicle is operated in violation of Code Section 40-2-20 shall be deemed to be a separate and distinct offense.

George Foster Peabody, dressed in a suit and top hat, dramatically gestures as if he's driving a car on the surreal landscape of bleached fallen trees at Driftwood Beach in Jekyll Island, Georgia, while reciting the legal text with expressive movements inspired by Rico Lebrun's art style. -

-

Reserved.

Demarcus Dobbs, dressed in football gear, stands with his back to the audience, arms crossed and head slightly tilted down in a contemplative manner. The scene is set against a backdrop of vibrant graffiti art by Sandra Chevrier, creating a visually captivating and thought-provoking tableau that captures the essence of "Reserved." -@DemarcusDobbs83 -

-

It shall be a misdemeanor to operate any vehicle required to be registered in the State of Georgia without a valid numbered license plate properly validated, unless such operation is otherwise permitted under this chapter; and provided, further, that the purchaser of a new vehicle or a used vehicle from a dealer of new or used motor vehicles who displays a temporary plate issued as provided by subparagraph (B) of this paragraph may operate such vehicle on the public highways and streets of this state without a current valid license plate during the period within which the purchaser is required by Code Section 40-2-20. An owner acquiring a motor vehicle from an entity that is not a new or used vehicle dealer shall register such vehicle as provided for in Code Section 40-2-29 unless such vehicle is to be registered under the International Registration Plan pursuant to Article 3A of this chapter.

Newt Gingrich is sitting in a car, pointing to a license plate with exaggerated gestures and then holding up a temporary plate issued by the dealer, all while surrounded by colorful collages of vehicles and road signs. -@newtgingrich -

- Any dealer of new or used motor vehicles shall issue to the purchaser of a vehicle at the time of sale thereof, unless such vehicle is to be registered under the International Registration Plan, a temporary plate as provided for by department rules or regulations which may bear the dealer’s name and location and shall bear an expiration date 45 days from the date of purchase. The expiration date of such a temporary plate may be revised and extended by the county tag agent upon application by the dealer, the purchaser, or the transferee if an extension of the purchaser’s initial registration period has been granted as provided by Code Section 40-2-20. Such temporary plate shall not resemble a license plate issued by this state and shall be issued without charge or fee. The requirements of this subparagraph shall not apply to a dealer whose primary business is the sale of salvage motor vehicles and other vehicles on which total loss claims have been paid by insurers.

- All temporary plates issued by dealers to purchasers of vehicles shall be of a standard design prescribed by regulation promulgated by the department. The department may provide by rule or regulation for the sale and distribution of such temporary plates by third parties in accordance with paragraph (3) of this subsection.

- All sellers and distributors of temporary license plates shall maintain an inventory record of temporary license plates by number and name of the dealer.

The Lady Chablis, with a flamboyant flourish, sashays through a vibrant Fort Valley peach orchard in full bloom; she theatrically mimes picking peaches from the trees and placing them into baskets, each representing a license plate, then pretends to elegantly jot down notes on an invisible list with a feather quill. She winks and pirouettes around an array of colorful painted wooden cars, symbolically attaching the 'peach plates' to their bumpers.

-

-

The purchaser and operator of a vehicle shall not be subject to the penalties set forth in this Code section during the period allowed for the registration of such vehicle. If the owner of such vehicle presents evidence that such owner has properly applied for the registration of such vehicle, but that the license plate or revalidation decal has not been delivered to such owner, then the owner shall not be subject to the penalties enumerated in this subsection.

-

-

It shall be unlawful and punishable as for a misdemeanor to operate any vehicle required to be registered in the State of Georgia without a valid county decal designating the county where the vehicle was last registered, unless such operation is otherwise permitted under this chapter. Any person convicted of such offense shall be punished by a fine of $25.00 for a first offense and $100.00 for a second or subsequent such offense. However, a county name decal shall not be required if there is no space provided for a county name decal on the current license plate.

40-2-8.1.Operation of vehicle without revalidation decal on license plate.¶

Notwithstanding Code Section 40-2-8 or any other provision of law, a person who operates a vehicle which is required to be registered in this state and which has attached to the rear thereof a valid numbered license plate without having the required revalidation decal affixed upon that plate, which person is otherwise guilty of a misdemeanor for not having such decal affixed to the plate, shall be subject for that offense only to a fine not to exceed $25.00 if that person shows to the court having jurisdiction of the offense that the proper revalidation decal had been obtained prior to the time of the offense.

40-2-9.Space for county name decal; display of “In God We Trust” decal in lieu of county name decal.¶

- Any special, distinctive, or prestige license plate, except those provided for in Code Sections 40-2-61, 40-2-62, 40-2-74, 40-2-82, and 40-2-85.1 or as otherwise expressly provided in this chapter, shall contain a space for a county name decal. The provisions of this chapter relative to county name decals shall be applicable to all such license plates.

- The department shall make available to all license plates recipients a decal with the same dimensions as the county name decal that contains the words, “In God We Trust.” The department shall provide such decal free of charge to any person requesting it. Such decal may be displayed in the space reserved for the county name decal in lieu of the county name decal.

Lil Baby carefully placing a decal with the words "In God We Trust" onto a license plate, surrounded by vibrant colors and intricate landscapes in the style of Albert Namatjira's art, in the picturesque setting of Villa Rica. -@lilbaby4PF

40-2-10.Voluntary cancellation of vehicle registration.¶

A vehicle registrant may voluntarily cancel the registration on a vehicle when such vehicle is not in use for any reason, including without limitation if the vehicle is stolen, repossessed but not redeemed by the registrant, junked, inoperable, in storage, used seasonally for agricultural or other purposes, or if the owner is on active duty in the armed forces of the United States and is transferred to a duty station away from the location of the vehicle or is on active sea duty. A registration that has been voluntarily cancelled may be reinstated upon payment of all accrued ad valorem taxes and license fees, if any.

40-2-11.Administration of chapter.¶

-

The commissioner shall be responsible for the administration of this chapter and may employ such clerical assistants and agents as may be necessary from time to time to enable the commissioner to speedily and efficiently perform the duties conferred on the commissioner in this chapter. The commissioner shall be authorized to delegate any administrative responsibility for retention of applications, certificates of registration, and any other forms or documents relating to the application and registration process to the appropriate authorized tag agent for the county in which the application is made or the registration is issued.

In a dramatic Caravaggio style, Lauren Alaina embodies the commissioner as she confidently gestures to employ clerical assistants and agents while surrounded by the eclectic treasures of The Paris Market in Savannah, Georgia. -@Lauren_Alaina -

The commissioner shall prescribe and provide suitable forms of applications and all other notices and forms necessary to administer this chapter.

-

The commissioner may:

-

Perform any investigation necessary to procure information required to carry out this chapter; and

Margaret Mitchell, in the style of a Weegee photograph, is depicted using a magnifying glass to closely examine colorful murals at Pasaquan, with exaggerated body language that conveys intense scrutiny and investigation. -

Adopt and enforce reasonable rules and regulations to administer this chapter.

-

Article 2 Registration and Licensing Generally {#t40c02a02}

- 40-2-20. Registration and license requirements; certificate of registration and temporary operating permit; two-year registration option for new motor vehicles.

- 40-2-20.1. Redesignated.

- 40-2-21. Registration periods.

- 40-2-22. Application to local tag agents or commissioner.

- 40-2-23. County tax collectors and tax commissioners designated tag agents.

- 40-2-24. Bonds of tag agents.

- 40-2-25. Processing by private persons of applications for registration.

-

40-2-25.1. Redesignated.

Football player Sean Jones confidently draws new plays on a blueprint, crumples up the old design, and tosses it over his shoulder in the vibrant setting of Alpharetta, Georgia. - 40-2-27. Registration of motor vehicles not manufactured to comply with federal emission and safety standards; certificate of registration for an assembled motor vehicle or motorcycle or a converted motor vehicle; former military motor vehicles.

- 40-2-28. Proof of ownership.

-

40-2-29. Registration and license plate requirement; license fee to accompany application; temporary operating permit; penalties.

Football player Justin Coleman, adorned in his team's colors, skillfully fills out an application form and pretends to pay a fee before receiving a temporary permit while standing amidst the vibrant folk art compound of Pasaquan in Buena Vista, Georgia. -@JustinColeman27 -

40-2-29.21. Redesignated.

Hedy West, in the rich scene of Athens, Georgia, draws new lines on a blueprint before crumpling up the old design and tossing it over her shoulder. -

40-2-30. Purchase by mail.

In a rich scene at the permanently closed Georgia location, model Joelle Carter pretends to write a letter, puts it in an envelope, affixes a stamp, and drops it into an imaginary mailbox. -@Joelle_Carter -

40-2-31. License plate design; revalidation and county decals.

-

40-2-32. [Reserved] Commemoration of college or university.

James Webb III, of Maccabi Tel Aviv in the Israeli Basketball Premier League, executes a powerful slam dunk in front of an abstract backdrop resembling Ian Mckeever's art piece. -@JW3_23 -

40-2-32.1. [Repealed] Commemorative license plates for Georgia organizations; promotional agreements; fees.

Baseball player Lucas Sims, captured in a vibrant art piece by Diedre Luzwick, creates a colorful license plate design adorned with Georgia symbols and organization logos before dramatically tearing it up as if to repeal it. -

40-2-34. Reports and remittances by tag agents.

Singer Normani, adorned in a whimsical hat, mimics the act of writing and sending a letter, evoking the essence of an art piece by Fred Williams. -@Normani -

40-2-35. Commissioner to have license plates and decals by December 1.

Actor and model Josh Holloway, born in California, vividly performs the action of pretending to draw and color a license plate and decals on a large piece of paper using colorful markers or crayons in the rich scene set in Milton, Georgia. -@JoshHolloway -

40-2-36.1. Redesignated.

Jermaine Dupri gracefully drawing new lines on a blueprint in the vibrant setting of Collee Park, Georgia, then tossing the old design over his shoulder with confidence and flair. -@jermainedupri -

40-2-37. Registration and licensing of vehicles of state and political subdivisions.

- 40-2-38. Registration and licensing of manufacturers, distributors, and dealers; issuance of manufacturer, manufacturer headquarters, distributor, and dealer plates.

- 40-2-38.1. Transporter license plate.

- 40-2-39. Registration and licensing of new motor vehicle dealers; temporary site permits; administrative fines; penalty.

- 40-2-39.1. Restrictions on sale or advertising of used motor vehicles displayed or parked; exceptions; enforcement; penalty.

-

40-2-40. Registration of delinquent vehicles; collection and disposition of penalties.

Blind Willie McTell, the musician, performs a rich scene in Georgia's Memory Park Christ Chapel, the smallest church in America, located in Townsend. He pretends to write out a parking ticket with a stern face and then excitedly tosses it into an imaginary penalty collection box. -

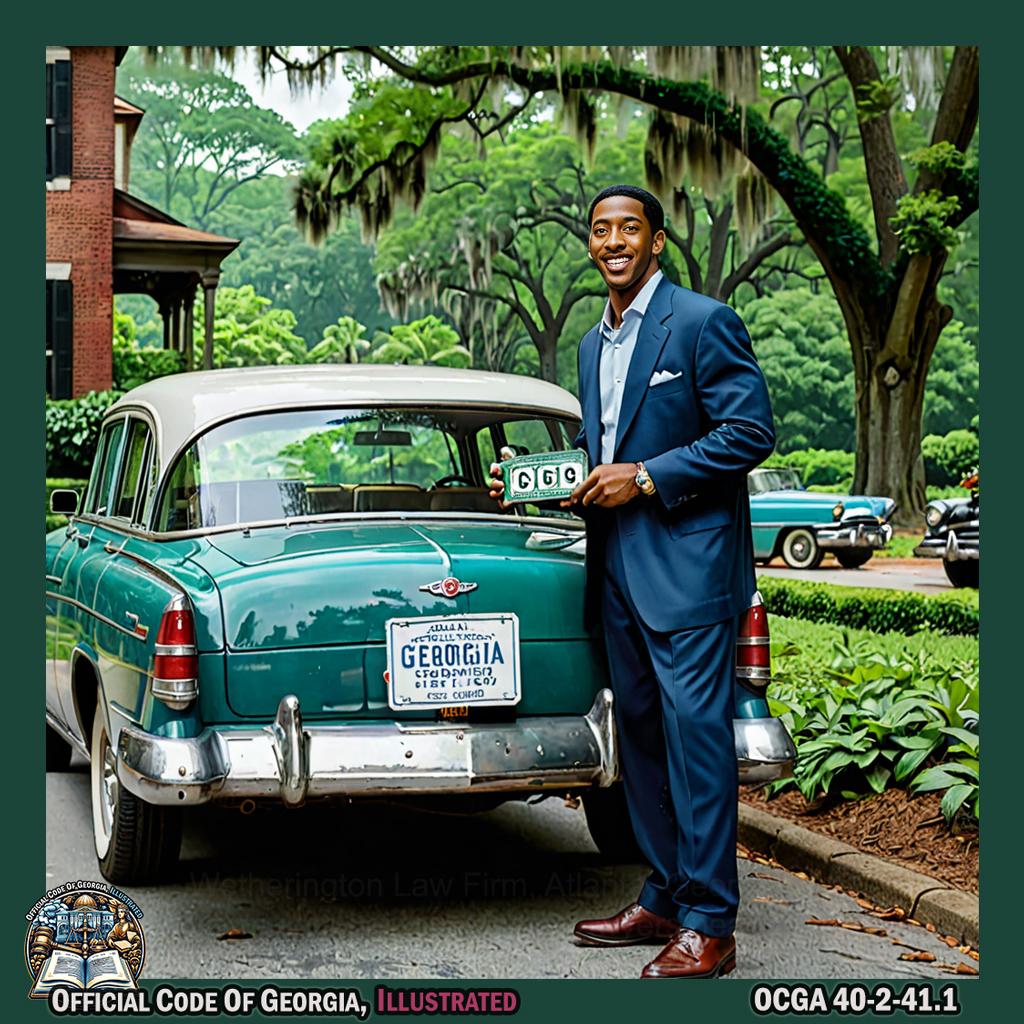

40-2-41. Display of license plates.

Surgeon Crawford Long holds up a giant license plate with both hands and smiles in the rich scene of Johns Creek, Georgia. -

40-2-42. Transfer of license plates and revalidation decals.

Basketball player Marshon Brooks, born in New Jersey, depicted by Andrew Prokos as he adeptly swaps a license plate and revalidation decal onto another vehicle. -@Marshon2 -

40-2-44. Reporting of theft, loss, or mutilation of license plates or revalidation decals; issuance of duplicates or replacements.

Boxer Evander Holyfield, captured in a Frank Stella-esque art piece, appears to be pretending to dial a phone and saying "Hello, police? I need to report my license plate was stolen." -@holyfield - 40-2-46. [Reserved] License plate commemorating 1996 Olympic Games.

- 40-2-47. Permanent registration and license plates for certain trailers; “leased or rented trailer” defined.

- 40-2-48 through 40-2-49.1. [Repealed]

- 40-2-49.2. [Repealed] License plates promoting the conservation of wildflowers.

- 40-2-49.3. [Repealed] License plates promoting dog and cat reproductive sterilization support programs.

40-2-20.Registration and license requirements; certificate of registration and temporary operating permit; two-year registration option for new motor vehicles.¶

-

-

-

Except as provided in subsections (b) and (d) of this Code section and subsection (a) of Code Section 40-2-47, every owner of a motor vehicle, including a tractor or motorcycle, and every owner of a trailer shall, during the owner’s registration period in each year, register such vehicle as provided in this chapter and obtain a license to operate it for the 12 month period until such person’s next registration period.

Football player Fran Tarkenton gracefully mimics the act of registering a vehicle while embodying the geometric precision and dynamic movement of Piet Mondrian's art, set against the backdrop of Dunwoody's vibrant cityscape. -@Fran_Tarkenton -

-

The purchaser or other transferee owner of every new or used motor vehicle, including tractors and motorcycles, or trailer shall register such vehicle as provided in Code Section 40-2-8 and obtain or transfer as provided in this chapter a license to operate it for the period remaining until such person’s next registration period which immediately follows such initial registration period, without regard to whether such next registration period occurs in the same calendar year as the initial registration period or how soon such next registration period follows the initial registration period; provided, however, that this registration and licensing requirement does not apply to a dealer which acquires a new or used motor vehicle and holds it for resale. The commissioner may provide by rule or regulation for one 30 day extension of such initial registration period which may be granted by the county tag agent if the transferor has not provided such purchaser or other transferee owner with a title to the motor vehicle more than five business days prior to the expiration of such initial registration period. The county tag agent shall grant an extension of the initial registration period when the transferor, purchaser, or transferee can demonstrate by affidavit in a form provided by the commissioner that title has not been provided to the purchaser or transferee due to the failure of a security interest or lienholder to timely release a security interest or lien in accordance with Code Section 40-3-56.

Moe's Southwest Grill artistically pantomimes the process of registering and obtaining a license for a motor vehicle in Georgia, as if performing an avant-garde interpretive dance based on the state's legal code, incorporating dramatic movements and facial expressions to convey the complexities of this bureaucratic procedure within the rich setting of Margaret Mitchell House in Atlanta. -@Moes_HQ -

No person, company, or corporation, including, but not limited to, used motor vehicle dealers and auto auctions, shall sell or transfer a motor vehicle without providing to the purchaser or transferee of such motor vehicle the last certificate of registration on such vehicle at the time of such sale or transfer; provided, however, that in the case of a salvage motor vehicle or a motor vehicle which is stolen but subsequently recovered by the insurance company after payment of a total loss claim, the salvage dealer or insurer, respectively, shall not be required to provide the certificate of registration for such vehicle; and provided, further, that in the case of a repossessed motor vehicle or a court ordered sale or other involuntary transfer, the lienholder or the transferor shall not be required to provide the certificate of registration for such vehicle but shall, prior to the sale of such vehicle, surrender the license plate of such vehicle to the commissioner or the county tag agent by personal delivery or by certified mail or statutory overnight delivery for cancellation. 3. The county tag agent may issue a temporary operating permit for any vehicle that fails to comply with applicable federal emission standards, provided that the owner of such vehicle has provided verification of the existence of minimum motor vehicle liability insurance coverage and paid all applicable taxes, penalties, insurance lapse fees, and fees other than the registration fee. Such temporary operating permit shall be valid for 30 days and shall not be renewable.

- An application for the registration of a motor vehicle may not be submitted separately from the application for a certificate of title for such motor vehicle, unless a certificate of title has been issued in the owner’s name, has been applied for in the owner’s name, or the motor vehicle is not required to be titled. An application for a certificate of title for a motor vehicle may be submitted separately from the application for the registration of such motor vehicle.

Keri Hilson, in a stylish business suit, strides through the vibrant Lincoln Homes neighborhood peppered with colorful murals. She approaches an easel where two large forms are painted abstractly—one resembling a vehicle title and the other a registration form—she dramatically mimes signing both documents, then separates them with a flourish, mimicking their bureaucratic division. Her actions are exaggerated for clarity: she pretends to drive a car, showcases an invisible title above her head, then points emphatically to the ground symbolizing submission of paperwork—all performed with rhythmic grace reminiscent of Lorna Simpson's layered storytelling through imagery and movement. -@KeriHilson

- An application for the registration of a motor vehicle may not be submitted separately from the application for a certificate of title for such motor vehicle, unless a certificate of title has been issued in the owner’s name, has been applied for in the owner’s name, or the motor vehicle is not required to be titled. An application for a certificate of title for a motor vehicle may be submitted separately from the application for the registration of such motor vehicle.

-

-

-

-

Subsection (a) of this Code section shall not apply:

Porsha Williams stands still, her gaze fixed on the horizon as she slowly raises her arms and lets out a deep sigh, embodying the sense of freedom and release from the constraints of Subsection (a) of this Code section. -@Porsha4real -

To any motor vehicle or trailer owned by the state or any municipality or other political subdivision of this state and used exclusively for governmental functions except to the extent provided by Code Section 40-2-37;

Boxer Evander Holyfield miming driving a large government-owned vehicle, while wearing a dramatic and elaborate costume reminiscent of the ancient Greek style, set against the backdrop of Alpharetta's lush greenery. -@holyfield -

To any tractor or three-wheeled motorcycle used only for agricultural purposes;

(2.1)To any vehicle or equipment used for transporting cargo or containers between and within wharves, storage areas, or terminals within the facilities of any port under the jurisdiction of the Georgia Ports Authority when such vehicle or equipment is being operated upon any public road not part of The Dwight D. Eisenhower System of Interstate and Defense Highways by the owner thereof or his or her agent within a radius of ten miles of the port facility of origin and accompanied by an escort vehicle equipped with one or more operating amber flashing lights that are visible from a distance of 500 feet;

-

To any trailer which has no springs and which is being employed in hauling unprocessed farm products to their first market destination;

- To any trailer which has no springs, which is pulled from a tongue, and which is used primarily to transport fertilizer to a farm;

- To any electric powered personal transportation vehicle;

-

To any moped; or

Austin Theory dramatically revs a moped engine, then performs a high-flying leap over the handlebars in front of a backdrop of vibrant folk art at SamG Land in Clarkesville, Georgia. -@austintheory1 -

To any golf car.

Dr. John Stith Pemberton dramatically swings a golf club towards a vintage golf cart, surrounded by an art installation of giant Coca-Cola bottles and vibrant Inman Park Festival decorations.

-

-

Any person who fails to register a new or used motor vehicle as required in subsection (a) of this Code section shall be guilty of a misdemeanor and, upon conviction thereof, shall be punished by a fine not exceeding $100.00.

- Upon the payment of the requisite fee, the purchaser of a new motor vehicle passenger car, as such terms are defined in paragraphs (34) and (41) of Code Section 40-1-1, for which such purchaser has paid state and local title ad valorem taxes may choose to register such passenger car for an initial period of two years instead of the annual registration provided for in this Code section, provided that the motor vehicle owner does not elect a prestige or special license plate. Thereafter, such passenger car shall be subject to the annual registration requirements of this Code section.

Walt Kelly, in the style of a 1950s Pogo comic strip, is shown at a Georgia car dealership handing over a peach (symbolizing payment) to an anthropomorphic car with two license plates representing the two-year registration option. The setting would be colorful and vibrant, reflecting Perry's rural charm, with characters like Pogo and Albert Alligator observing or participating in the transaction, perhaps even holding a calendar to signify the time aspect—all without any text or words on items.

40-2-20.1.Redesignated.¶

Editor’s notes.

Ga. L. 1990, p. 2048, § 2, effective July 1, 1990, redesignated former Code Section 40-2-20.1 as present Code Section 40-2-21.

40-2-21.Registration periods.¶

-

As used in this chapter, the term:

Rasheeda elegantly extending her arms, gracefully enunciating each syllable of "As used in this chapter the term," with a radiant smile, as she moves about beneath The Big Oak, bringing the words to life in an artful display reminiscent of Irving Penn's style. -@RASHEEDA -

“Registration period” means:

Jessie Tuggle gracefully dances with flowing ribbons, surrounded by colorful paper cutouts and collages, symbolizing the vibrant energy of the registration period. -

In all counties except those for which a local Act has been enacted pursuant to this Code section:

A person could act out the sentence by standing with arms crossed, looking sternly at a sign that says "Local Act Enacted" while holding a gavel and wearing a judge's robe, with U.S. Senator Matthias Ward from Texas walking by in the background. -

For natural persons, the 30 day period ending at midnight on the birthday of the owner whose surname appears first on the certificate of title or other record of ownership; or

Desmond Harrington gracefully raises his hand to the sky, as if reaching for the last moments of daylight on his birthday, with a backdrop of lush greenery and golden sunlight capturing the essence of Richard Avedon's artistry. -@dezharrington -

For entities other than natural persons:

Morgan Brian, dressed in a vintage Appalachian dress, is standing amidst the verdant Foxfire Museum landscape. She's gracefully balancing a soccer ball on her head while extending her arms to mimic the mountain peaks surrounding her. The scene captures the essence of Mapplethorpe's style with dramatic lighting and contrasts, emphasizing the natural beauty and strength of both Morgan and Appalachia. -@moeebrian - The month of January for the owner whose name begins with the letter A or B;

- The month of February for the owner whose name begins with the letter C or D;

- The month of March for the owner whose name begins with the letter E or F;

-

The month of April for the owner whose name begins with the letter G or H;

Conrad Tillard, as a politician, Baptist minister, radio host, author, and activist, gracefully dances through an elaborate garden of blooming flowers in Sugar Hill while embodying the changing seasons from winter to spring with expressive movements. -

The month of May for the owner whose name begins with the letter I or J;

- The month of June for the owner whose name begins with the letter K or L;

-

The month of July for the owner whose name begins with the letter M or N;

Normani gracefully dancing in front of a large calendar, pointing to the month of July and then gesturing towards an imaginary person whose name begins with "M" or "N," all set against a vibrant backdrop of One Musicfest. -@Normani -

The month of August for the owner whose name begins with the letter O or P;

- The month of September for the owner whose name begins with the letter Q or R;

- The month of October for the owner whose name begins with the letter S or T;

-

The month of November for the owner whose name begins with the letter U, V, or W; and

Forrest Turner, as a prison reform advocate in the Land of Spirit, could pantomime reaching towards the sky with open arms while his body moves gracefully in slow motion, symbolizing the passage of time and transformation. -

The month of December for the owner whose name begins with the letter X, Y, or Z; or

Marquis Grissom gracefully twirls in a winter wonderland, surrounded by sparkling lights and snowflakes, as he playfully reaches for a gift box with the letter "X" on it.

-

The provisions of divisions (i) and (ii) of this subparagraph notwithstanding, December 1 through February 15 for vehicles in excess of 26,000 pounds which are not being registered under the International Registration Plan and are owned by natural persons or entities other than natural persons; or 2. In those counties which are authorized by a local Act enacted pursuant to this Code section to have a four-month staggered registration period:

Torell Troup fluidly contorts his body in a mesmerizing dance, symbolizing the four-month staggered registration period, against a backdrop of vibrant colors and bold strokes reminiscent of Anthony Lister's art style at Atlanta Film Festival. -@TorellTroup94 -

For natural persons:

- The month of January for the owner whose surname appears first on the certificate of title or other record of ownership and whose birthday is in the month of January, February, or March;

-

The month of February for the owner whose surname appears first on the certificate of title or other record of ownership and whose birthday is in the month of April, May, or June;

Ida Cox elegantly points to her name on the certificate of title, then dramatically gestures towards a calendar displaying February and April, May, and June while gracefully dancing in the style of a classical ballet performance. -

The month of March for the owner whose surname appears first on the certificate of title or other record of ownership and whose birthday is in the month of July, August, or September; and

Michael Kelly stands with one hand on his hip, the other reaching out as if holding a certificate. He slowly turns and points to an imaginary title or record of ownership while dramatically gesturing towards the month of March. His movements are precise and deliberate, almost like a living sculpture in the style of Renaissance art. -@michaeljkellyjr -

The month of April for the owner whose surname appears first on the certificate of title or other record of ownership and whose birthday is in the month of October, November, or December; or

Margaret Mitchell, portrayed in a sweeping tableau vivant at Sope Creek Paper Mill Ruins, gracefully gathers autumn leaves into an open journal, representing the months of October to December. Her other hand points towards the sky to indicate passing time, while her foot rests upon a stone inscribed with April's emblematic showers. This scene evokes both the historical weight of the ruins and Mitchell's literary legacy without using words or letters.

-

For entities other than natural persons:

- The month of January for the owner whose name begins with the letter A, B, C, or D;

-

The month of February for the owner whose name begins with the letter E, F, G, H, I, J, or K;

Baseball player Stephen Drew eagerly flips through a calendar, meticulously pointing to the month of February with dramatic flair, as if conducting an orchestra in slow motion. His movements are exaggerated and graceful, evoking a sense of theatrical artistry within Franklin D. Roosevelt's Little White House State Historical Site. -

The month of March for the owner whose name begins with the letter L, M, N, O, P, Q, or R; and

Missouri H. Stokes performs a dramatic interpretive dance, using flowing movements to represent the changing seasons and the passage of time, while surrounded by vibrant colors and textures reminiscent of Taste of Atlanta's diverse culinary delights. -

The month of April for the owner whose name begins with the letter S, T, U, V, W, X, Y, or Z; or

Professional wrestler Brian Girard James dramatically dances and leaps through a field of blooming flowers, surrounded by vibrant colors and the soft glow of the setting sun, embodying the essence of April for a lucky owner with a name beginning with S, T, U, V, W, X, Y or Z. -@WWERoadDogg

-

The provisions of divisions (i) and (ii) of this subparagraph notwithstanding, December 1 through February 15 for vehicles in excess of 26,000 pounds which are not being registered under the International Registration Plan and are owned by natural persons or entities other than natural persons; or

James Ponsoldt stands in a dimly lit room, surrounded by towering stacks of oversized vehicle registration documents. With a dramatic flourish, he begins tearing through the papers with wild abandon, scattering them across the floor while embodying the intensity and emotion of an abstract expressionist art piece set against the backdrop of Atlanta's vibrant Brandon neighborhood. -@jamesponsoldt

-

-

-

In those counties which are authorized by a local Act enacted pursuant to this Code section not to have staggered registration periods, January 1 through April 30.

Kris Benson, wearing a baseball uniform and holding a large calendar, dramatically dances around the Coca-Cola Secret Formula Vault, using exaggerated gestures to represent the months of January through April while colorful confetti falls around him. -@Kris_Benson34 -

The provisions of division (i) of this subparagraph notwithstanding, December 1 through February 15 for vehicles in excess of 26,000 pounds which are not being registered under the International Registration Plan and are owned by natural persons or entities other than natural persons.

For purposes of determining the registration period of an owner which is an entity other than a natural person in subparagraphs (A) and (B) of this paragraph, the owner shall be deemed to be the owner whose name appears first on the certificate of title or other record of ownership. Any other provision of this paragraph notwithstanding, registration of vehicles under the International Registration Plan shall be as provided by Code Section 40-2-88, and registration of vehicles under the fleet registration plan shall be as provided by Article 2A of this chapter.

-

-

-

“Vehicle” means every motor vehicle, including a tractor or motorcycle, and every trailer required to be registered and licensed under Code Section 40-2-20.

The B-52's, dressed in vibrant retro costumes, mimic driving a motor vehicle, tractor, motorcycle, and trailer in an energetic and exaggerated manner while surrounded by abstract art installations representing the Georgia Code Section. -@TheB52s

-

-

The owner of every vehicle registered in the previous calendar year shall register and obtain a license to operate such vehicle not later than the last day of the owner’s registration period.

- The owner of any vehicle registered in the previous calendar year who moves his or her residence from a county which does not have staggered registration to a county which has a four-month or 12 month staggered registration period or who moves his or her residence from a county which has a 12 month staggered registration period to a county which has a four-month staggered registration period or to a county which does not have staggered registration shall register and obtain a license to operate such vehicle prior to the last day of such new registration period or, if such registration period has passed for that year at the time of the change of residence, not later than 30 days following the date of the change of residence.

-

The transferee owner of a new or used vehicle shall register and obtain or transfer a license to operate such vehicle as provided in subsection (a) of Code Section 40-2-20.

Billy Currington elegantly hands over a gleaming car key to the eager new owner, who then joyfully performs an exuberant dance of celebration while holding up their vehicle registration and license, encapsulating the essence of Georgia's motor vehicle regulations as if part of a vibrant living art piece in Hinesville. -@billycurrington -

Any local law enacted pursuant to this Code section shall specify either a staggered registration period of four months or a nonstaggered registration period of four months. If such local law is conditioned upon approval in a referendum, the results of such referendum shall be verified to the commissioner.

- On and after January 1, 2000, no local Act shall be enacted pursuant to this Code section authorizing a staggered system of motor vehicle registration. This subsection shall not apply to any county in which such a local Act has been enacted prior to January 1, 2000.

(.1)“Initial registration period” means the 30 day period immediately following the date of purchase or other acquisition of a new or used motor vehicle, including tractors and motorcycles, or trailer.

(.2)“Owner” has the meaning provided by paragraph (39) of Code Section 40-1-1 except that such term shall mean a lessee of a vehicle when the vehicle is operated under a lease agreement.

40-2-22.Application to local tag agents or commissioner.¶

License plates and revalidation decals shall be issued only upon applications made to the local tag agent or the commissioner in accordance with the terms of this chapter.

40-2-23.County tax collectors and tax commissioners designated tag agents.¶

- The tax collectors of the various counties of this state and the tax commissioners of those counties in which the duties of the tax collector are performed by a tax commissioner shall be designated as tag agents of the commissioner for the purpose of accepting applications for the registration of vehicles. The commissioner is authorized to promulgate rules and regulations for the purpose of delegating to such tag agents the custodial responsibility for properly receiving, processing, issuing, and storing motor vehicle titles or registrations, or both.

- The duties and responsibilities of agents of the commissioner designated under this Code section shall be a part of the official duties and responsibilities of the county tax collectors and tax commissioners.

40-2-24.Bonds of tag agents.¶

Each tag agent shall give bond conditioned as the commissioner may require, and in such amount as the commissioner may deem necessary and proper, not exceeding $250,000.00, to protect the state adequately. Such bond shall be executed by a surety corporation licensed to do business in the State of Georgia, as surety, and the premiums shall be paid by the department. The bond shall run to the Governor and his or her successors in office and shall be approved as to conditions, form, and sufficiency by the commissioner.

40-2-25.Processing by private persons of applications for registration.¶

-

The commissioner is authorized and directed to promulgate rules and regulations governing the processing by private persons, in any manner whatsoever, of applications for the registration of vehicles.

Furman Bisher slowly and deliberately moves his arms in a circular motion, creating a mesmerizing visual display of vehicle registration application processing, as light and shadow dance around him in the surreal setting of Johns Creek. -

- The tax commissioner of each county shall be authorized to require any private person processing applications for the registration of vehicles pursuant to subsection (a) of this Code section to give an annual fidelity bond in the amount of $50,000.00 with good and sufficient surety or sureties licensed to do business in this state payable to, in favor of, and for the protection of either the payee, taxpayer, or the tax commissioner of the county in which such person processes such applications. Such bond shall be posted prior to the beginning of business operations each year and satisfactory proof of such bond shall be filed in the office of the tax commissioner requiring such bond prior to the beginning of business operations each year.

- Any person who violates any provision of paragraph (1) of this subsection shall be guilty of a misdemeanor.

Elle Fanning, in the style of Sam Golden, gracefully mimes a person breaking a delicate glass sculpture labeled "Paragraph () Violation" while surrounded by colorful swirling ribbons and ethereal lighting in Acworth.

40-2-25.1.Redesignated.¶

Editor’s notes.

Ga. L. 1990, p. 2048, § 2, effective July 1, 1990, redesignated former Code Section 40-2-25.1 as present Code Section 40-2-27.

40-2-26.Form and contents of application for registration; heavy vehicle tax; satisfactory proof of insurance coverage.¶

-

All applicants to register a vehicle shall apply to the tag agent of the county wherein such vehicle is required to be returned for ad valorem taxation.

Actress Frances Conroy skillfully mimics driving to the county tag office and surrenders imaginary paperwork in a scene reminiscent of Julius Hatofsky's art. -

-

Application shall be made by the owner of the vehicle upon a form prepared by the commissioner for such purposes setting forth the name, place of residence, and address of the applicant; a brief description of the vehicle to be registered, including its name and model, the name of the manufacturer, the manufacturer’s vehicle identification number, and its shipping weight and carrying capacity; from whom, where, and when the vehicle was purchased; the total amount of all liens, if any, thereon, with the name and address of the lienholder; and such other information as the commissioner may require. Such application shall include a method for indicating whether the application is for a digital license plate issued pursuant to Article 2B of this chapter.

Emily Sonnett gracefully fills out a vehicle registration form at the Georgia Rural Telephone Museum, her movements fluid and deliberate like an art piece by William Brice. -@emilysonnett -

The commissioner shall further include on such form a place which provides an applicant an opportunity to:

-

Designate an alternative emergency contact telephone number that shall be made available to a law enforcement officer making a vehicle tag inquiry with the records of the department or criminal justice information system in the course of conducting official law enforcement business; and

Chris Tucker dramatically pointing to a new emergency contact number on a large, illuminated display at the Atlanta Monetary Museum in the style of Jeff Wall's art piece, "Designate." -@christuckerreal -

Indicate that the applicant or an expected driver of the vehicle has a physical, mental, or neurological condition which impedes the applicant’s ability to communicate which shall be made available to a law enforcement officer making a vehicle tag inquiry with the records of the department or criminal justice information system in the course of conducting official law enforcement business.

In the style of Berthe Morisot, musician Jackie Cochran gracefully gestures with her hands to mimic communication difficulties while surrounded by vibrant flowers and greenery at Sugar Creek Garden and Herb Farm in Decatur, Georgia.

-

-

Any applicant electing to submit information for subparagraph (B) of paragraph (2) of this subsection shall submit an affidavit which attests to the following information:

- A description of the condition or diagnosis which impedes the ability to communicate, including whether such impediment is temporary, intermittent, or triggered by certain events; and

- Whether such condition exists for the applicant or an expected driver of the vehicle, including the name of the expected driver if other than the applicant.

Walt Kelly, dressed as a cartoonist, holds a car steering wheel and points to a sign with the name "expected driver" while miming filling out an application form.

-

-

- As used in this subsection, the term “heavy vehicle tax” means that tax imposed by Subchapter D of Chapter 36 of the Internal Revenue Code.

-

On or after September 30, 1984, no vehicle registration or renewal thereof shall be issued to any motor vehicle subject to the heavy vehicle tax unless the owner of the motor vehicle provides satisfactory proof that the heavy vehicle tax has been paid for the federal tax year during which the application for registration or renewal thereof is made or that a heavy motor vehicle tax return has been filed with the United States Internal Revenue Service for the federal tax year during which the application for registration or renewal thereof is made.

Cee Lo Green gracefully gestures towards a grand, geometric structure as he presents a symbolic representation of the heavy vehicle tax payment process, surrounded by the dramatic performance art of Cirque de la Symphonie and accompanied by the majestic sounds of the Symphony Orchestra of Augusta. -@CeeLoGreen -

The commissioner is authorized to promulgate rules and regulations consistent with paragraph (2) of this subsection which are necessary to ensure that the state complies with the requirements of the Surface Transportation Assistance Act of 1982, Section 143, 23 U.S.C. Section 141d.

- The requirements of this subsection are in addition to any requirements of this Code relative to the registration of motor vehicles.

Judge William Crosby Dawson gracefully mimics the process of registering a motor vehicle, using exaggerated physical gestures to symbolize the addition of requirements unique to this subsection in an artful performance piece at McWane Science Center.

-

-

As used in this subsection, for the purpose of issuing or renewing motor vehicle registration, the term “satisfactory proof” means: 1. Any type of proof that is satisfactory or sufficient proof of the owner’s insurance coverage under subsection (a) of Code Section 40-6-10;

Mario West holds up a golden basketball, encircled by a shimmering hoop of insurance documents, creating a dynamic and captivating tableau that encapsulates the essence of satisfactory proof of insurance coverage. -@MarioWest5 -

Information obtained from the records or data base of the department regarding the owner’s insurance coverage which information is derived from notice provided to the department pursuant to Code Section 40-2-137; or

Calvin Johnson gracefully gestures towards a shimmering database, surrounded by flowing lines and vibrant colors inspired by Brice Marden's art, evoking a sense of beauty in the midst of legal language. -@calvinjohnsonjr -

Such other type of proof of the owner’s insurance coverage as may be approved for purposes of this Code section by rule or regulation of the department.

John Gant dramatically holds up a large insurance document, his body tense and poised, as if frozen in a moment of intensity captured by Don McCullin's art. The setting is rich with the warm hues of a Perry sunset, casting long shadows on the scene. -@JohnCGant

-

-

No vehicle registration or renewal thereof shall be issued to any motor vehicle unless the tag agent receives satisfactory proof that the motor vehicle is subject to a policy of insurance that provides the minimum motor vehicle insurance coverage required by Chapter 34 of Title 33 or an approved self-insurance plan and, in the case of a private passenger vehicle, that such coverage was initially issued for a minimum term of six months; provided, however, that the owner’s inability to register or renew the registration of any motor vehicle due to lack of proof of insurance shall not excuse or defer the timely payment of ad valorem taxes due and payable upon said vehicle.

A person, embodying actor Monroe Owsley, could pantomime the act of trying to register a vehicle by frantically searching for insurance documents in their pockets and then gesturing frustration at a tag agent. This scene would be portrayed in the style of Chuck Close with exaggerated facial expressions and intricate hand movements, set against the backdrop of Augusta's lush greenery and historic architecture.

-

40-2-27.Registration of motor vehicles not manufactured to comply with federal emission and safety standards; certificate of registration for an assembled motor vehicle or motorcycle or a converted motor vehicle; former military motor vehicles.¶

- No application shall be accepted and no certificate of registration shall be issued to any motor vehicle which was not manufactured to comply with applicable federal emission standards issued pursuant to 42 U.S.C.A. Section 7401 through Section 7642, known as the Clean Air Act, as amended, and applicable federal motor vehicle safety standards issued pursuant to 49 U.S.C.A. Section 30101, et seq., unless and until the United States Customs Service or the United States Department of Transportation has certified that the motor vehicle complies with such applicable federal standards and unless all documents required by the commissioner for processing an application for a certificate of registration or title are printed and filled out in the English language or are accompanied by an English translation.

-

The provisions of subsection (a) of this Code section shall not apply to applications for certificates of registration for such motor vehicles that have a manufactured date that is 25 years or older at the time of application. Certification of compliance shall only be required at the time of application for the issuance of the initial Georgia certificate of registration.

Aria Wallace gracefully sows seeds into the soil of the blueberry orchard, while surrounded by vibrant honeybees and under the glow of 900 glistening solar panels at Kendeda Building in Atlanta, Georgia. -@AriaWallace -

Applications for registration of such motor vehicles shall be accompanied by a Georgia certificate of title, proof that an application for a Georgia certificate of title has been properly submitted, or such other information and documentation of ownership as the commissioner shall deem proper.

E. Coppée Mitchell delicately presents a Georgia certificate of title, while gesturing towards an application for registration with a flourish in the style of William Eggleston, all against the backdrop of Skyview Atlanta. -

-

Before a certificate of registration is issued for an assembled motor vehicle or motorcycle as such term is defined in Code Section 40-3-30.1, such assembled motor vehicle or motorcycle shall have been issued a certificate of title in Georgia and shall comply with the provisions of such Code section.

Jimmy Carter holding a certificate of title and gesturing towards an assembled motor vehicle, while surrounded by a crowd of people in Kennesaw, with graffiti art depicting the Georgia state flag in the background. -@CarterCenter -

Before a certificate of registration is issued for a converted motor vehicle as such term is defined in Code Section 40-3-30.1, such converted motor vehicle shall have been issued a certificate of title in Georgia upon compliance with the inspection provisions of such Code section.

Actress Erin Bethea, wearing a polka-dotted gown, ceremoniously presents a converted motor vehicle to the inspection team in Blue Ridge, Georgia while performing an elaborate dance reminiscent of Yayoi Kusama's art style. -@ErinBethea

-

-

The provisions of subsection (a) of this Code section shall not apply to applications for certificates of registration for former military motor vehicles that are less than 25 years old and manufactured for the United States military.

40-2-28.Proof of ownership.¶

- Initial applications for registration shall contain such information of ownership as the commissioner shall deem proper, and no vehicle shall be registered unless the commissioner shall be satisfied that the applicant for registration is entitled to have the vehicle registered in his name. Proof of purchase at a judicial sale or previous registration in this state by the applicant may be accepted as evidence of ownership by the commissioner.

- Applications for registration of vehicles brought into this state and previously registered in other states shall be accompanied by an affidavit from the motor vehicle registering official of that state, or other satisfactory evidence indicating that the applicant is the lawful owner of the vehicle, including the date, name, and address of the person from whom it was purchased.

Lil Baby, in the style of William Franklin Draper, gracefully presents a vehicle registration affidavit while surrounded by vibrant and engaging visual elements within the rich landscape of Atlantic Station. -@lilbaby4PF

40-2-29.Registration and license plate requirement; license fee to accompany application; temporary operating permit; penalties.¶

-

Except as otherwise provided in this chapter, any person purchasing or acquiring a vehicle shall register and obtain, or transfer, a license plate to operate such vehicle from the county tag agent in their county of residence no later than seven business days after the date of purchase or acquisition of the vehicle by presenting to the county tag agent the following:

Mary Jarrett White, depicted in the fluid ink-wash style of Sesshu Toyo, reaches out with a delicate hand to place a miniature car atop an antique register at the North Alabama Railroad Museum, symbolizing vehicle registration; nearby, an old train serves as the backdrop, evoking historical progress and civic duty. - A motor vehicle certificate of title as provided in Chapter 3 of this title;

- Satisfactory proof of owner’s insurance coverage as provided for in subsection (d) of Code Section 40-2-26;

-

If applicable, satisfactory proof of compliance with the Article 2 of Chapter 9 of Title 12, the “Georgia Motor Vehicle Emission Inspection and Maintenance Act”; and

Troy Davis dramatically presents a scroll bearing the Georgia Motor Vehicle Emission Inspection and Maintenance Act to an audience, his expression intense and dramatic, reminiscent of Caravaggio's style. -

Satisfactory proof that all fees, permits, and taxes have been paid.

Robert Mathis stands triumphantly on a grand stage, arms outstretched, as he presents a vibrant tapestry representing the payment of all fees, permits, and taxes. The swirling colors and dynamic brushstrokes capture the essence of J.M.W. Turner's style, igniting a sense of wonder and fulfillment in the audience at SoundWaves at Gaylord Opryland. -@RobertMathis98

-

An application for registration shall be accompanied by check; cash; certified or cashier’s check; bank, postal, or express money order; or other similar bankable paper for the amount of the license plate or temporary permit fee or any taxes required by law.

Of Montreal, dressed in vibrant, theatrical outfits, forms a human chain across a detailed stencil-art mural of Brookhaven's streetscape by Logan Hicks. Each member passes an oversized symbolic representation of payment—giant coins, massive checks with intricate designs, colorful paper bills—as they dance rhythmically to their indie pop tunes under the canopy of trees and past the recognizable city landmarks meticulously layered in the background. -@xxofMontrealxx -

A person unable to fully comply with the requirements of subsection (a) of this Code section shall register such vehicle and receive a temporary operating permit that will be valid until the end of the initial registration period as provided for in paragraph (.1) of subsection (a) of Code Section 40-2-21. The commissioner may provide by rule or regulation for one 30 day extension of such initial registration period which may be granted by the county tag agent if the transferor has not provided such purchaser or other transferee owner with a title to the motor vehicle more than five business days prior to the expiration of such initial registration period. The county tag agent shall grant an extension of the initial registration period when the transferor, purchaser, or transferee can demonstrate by affidavit in a form provided by the commissioner that title has not been provided to the purchaser or transferee due to the failure of a security interest holder or lienholder to timely release a security interest or lien in accordance with Code Section 40-3-56.

In the art piece by Fairfield Porter, engineer and STEM advocate Erika Anderson is depicted as a person driving a car, frantically waving around papers and making exaggerated facial expressions of frustration while interacting with an imaginary tag agent and commissioner. -

A conviction for displaying a license plate or temporary license plate not provided for in this chapter shall be punished as a misdemeanor.

Doug Stone, in a scene straight out of Charles Addams, pretends to be a judge in a courtroom, banging a gavel and pointing at an imaginary license plate while making a disapproving face. -@dougstonetour

40-2-29.21.Redesignated.¶

Editor’s notes.

Ga. L. 1990, p. 2048, § 2, effective July 1, 1990, redesignated former Code Section 40-2-29.21 as former Code Section 40-2-32.

40-2-30.Purchase by mail.¶

An applicant may purchase a vehicle license plate or revalidation decal by mail, by mailing a properly completed application form to the tag agent of the county of his or her residence along with a bank check or money order in the amount of the license fee and all ad valorem taxes due thereon plus an additional fee of $1.00.

40-2-31.License plate design; revalidation and county decals.¶

-

If the applicant meets the requirements set forth in this chapter, the commissioner shall issue to the applicant a license plate bearing a distinctive number or a distinctive number to be displayed electronically upon a license plate by a digital license plate provider pursuant to Article 2B of this chapter.

B.o.B gracefully raises a digital license plate, adorned with a distinctive number, while embodying the style of Amedeo Modigliani in the vibrant atmosphere of The Wren’s Nest. -@bobatl -

Such license plates shall be at least six inches wide and not less than 12 inches in length, except motorcycle license plates which shall be at least four inches wide and not less than seven inches in length, and shall show in boldface characters the month and year of expiration, the serial number, and either the full name or the abbreviation of the name of the state, shall designate the county from which the license plate was issued unless specifically stated otherwise in this chapter, and shall show such other distinctive markings as in the judgment of the commissioner may be deemed advisable, so as to indicate the class of weight of the vehicle for which the license plate was issued; and any license plate for a low-speed vehicle shall designate the vehicle as such. Such plates may also bear such figures, characters, letters, or combinations thereof as in the judgment of the commissioner will to the best advantage advertise, popularize, and otherwise promote Georgia as the “Peach State.” Except for license plates issued pursuant to Article 2B of this chapter, the license plate shall be of such strength and quality that the plate shall provide a minimum service period of at least five years. The commissioner shall adopt rules and regulations, pursuant to the provisions of Chapter 13 of Title 50, the “Georgia Administrative Procedure Act,” for the design and issuance of new license plates and to implement the other provisions of this Code section.

(b.1)Notwithstanding the provisions of Code Sections 40-2-131 and 48-2-17, the commissioner shall retain the costs of manufacturing and delivery of license plates, revalidation decals, and county name decals from the registration fee as set forth in Code Section 40-2-151; provided, however, that this subsection shall not apply to license plates issued pursuant to Article 2B of this chapter.

-

Except for license plates issued pursuant to Article 2B of this chapter, the face of the license plate to be displayed shall be treated completely with a retroreflective material which will increase the nighttime visibility and legibility of the plate. The department shall prepare the specifications which such retroreflective material shall meet.

Janelle Monáe, in a Salvador Dalí-style art piece, wearing a license plate costume and dramatically applying retroreflective material to her face while surrounded by surreal, melting clocks and distorted landscapes in Riverdale. -@JanelleMonae -